As stated previously, taxation has evolved throughout history, even though the principles remain almost the same from ages. Let us look at an ephemeral chronicle of taxation.

Brief history of taxation

The earliest taxes in Mesopotamia (In ancient Mesopotamia, according to a contemporary proverb, the person you should fear the most is the tax collector and it is still true till today), ancient Egypt, and elsewhere were in the form of shares or tithes of crops or other manufactured goods, and labour obligations which consist of military service or work on building projects. Money appeared much later, and therefore taxes were paid in kind.

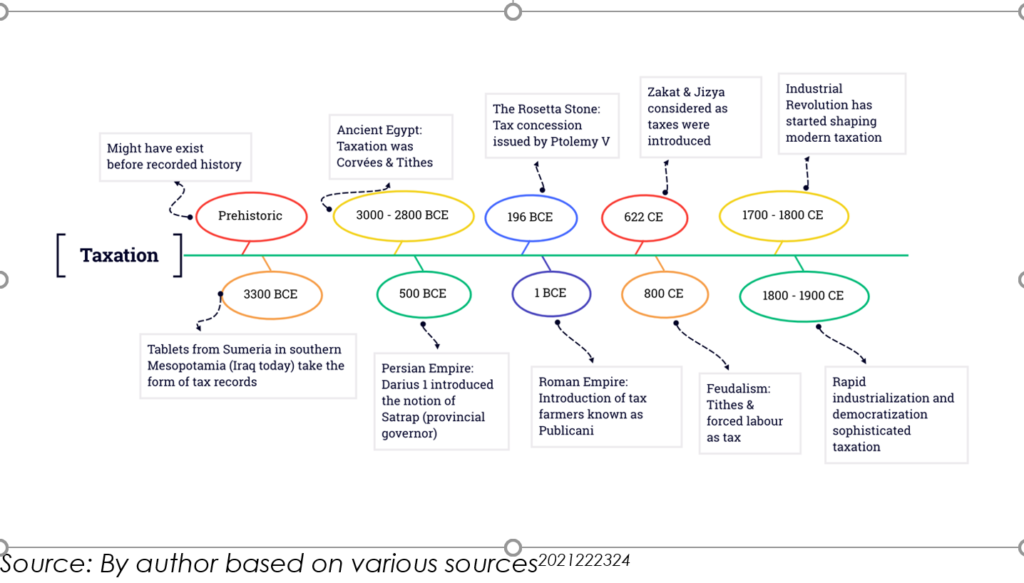

The figure below shows a short history of taxation over ages.

Figure 5: Short history of taxation

Source: By author based on various sources[1][2][3][4][5]

However, while using money, taxes were still paid in kind even recently during colonization in different part of the world. So, what is the real origin of tax?

Origin of Tax

It has often been said that taxation is a veritable mechanism for raising revenue for government expenditure programmes and a tool for moderating a nation’s economic activities. But then, what is the origin of tax?

The word ‘tax’ first appeared in the English language only in the 14th century. There are also Biblical accounts of the emergence of taxes. For instance, the first exemption from taxes is recorded in the Holy Bible in 1st Samuel 17 (25) as follows: “So the men of Israel said……….and give his father’s house exemption from taxes.”

According to Somorin (2016), Income tax was first implemented in Great Britain by William Pitt the Younger in his budget of December 1798 to pay for weapons and equipment in preparation for the Napoleonic Wars. Pitt’s income tax was levied from 1799 to 1802, until it was abolished by Henry Addington. Thus, Great Britain imposed the first general income tax in 1799 to help finance their war against Napoleonic France. The income tax was

reintroduced by Addington in 1803 when hostilities recommenced, but it was again abolished in 1816, one year after the Battle of Waterloo. To be re- introduced much later.

In 1798, Congress enacted the Federal Property Tax to pay for the expansion of the Army and Navy in the event of possible war with France. The first income tax suggested in the United States was during the War of 1812. The Tax Act of 1861 proposed that “there shall be levied, collected, and paid, upon annual income of every person residing in the U.S. whether derived from any kind of property, or from any professional trade, employment, or vocation carried on in the United States or elsewhere, or from any source whatever.

The term ‘tax’ has been defined as a compulsory transfer or payment of money occasionally of goods and services from the private individuals, institutions or groups to raise revenue to finance government expenditures. It may be levied upon wealth or income, or the form of surcharge price. O. Akanle defines tax “as a compulsory levy imposed on a subject or upon his property by the government having authority over him.”

In Nigeria, the history of taxation can be divided into five periods as follows:

(i)Pre and Colonial Period up to 1959;

(ii)1960- 1978;

(iii)1979 -1993;

(iv)1994-2007;

(v)2007-2016.

Taxation is administered by laws and regulations. Taxes are classified into different categories with specific principles governing them.

Classification of taxation

In the public finance literature, taxes are classified differently according to taxpayer, primary payer, extent of burden shifting, and a number of other criteria. Taxes are most commonly classified as direct or indirect taxes, for instance, the former being an Income Tax and the latter being a Value Added Tax (VAT).

- Direct taxes are predominantly taxes on persons (e.g. individuals) and are generally based on the taxpayer’s ability to pay, as measured by income, consumption or net worth.

- Indirect taxes are collected on the production or consumption of goods and services, or on transactions, including imports and exports. Examples are general and selective sales taxes, excises duties, taxes on any aspect of production, taxes on legal transactions, and customs or import duties[6].

Principles of taxation

“Whenever the principles of taxation are referred to, majority of people think instantly of the famous four canons of Adam Smith, the father of economic science. A sound tax-system is one which adheres to these famous canons. These canons are called fundamental principles of taxation. These have indeed performed nobel service in economic thought and teaching for over a hundred years.”

Adam Smith, in his major work An Inquiry into the Nature and Causes of The Wealth of Nations, simply referred to as Wealth of Nations, published in 1776, set out four principles, or ‘canons’ which should govern tax policy.

Canons of Taxation refers to a set of criteria used in the selection of a tax base or more appropriately the characteristic that a quality tax system should have. Renowned classical economists and Physiocrats such as Adam Smith, and J.S Mill enunciated some canons of taxation

Adam Smith, seemed to be the first person to design four main principles or characteristics of a good tax system in his influential twin book, where he referred to the principles as “Canons of Taxation” for a tax system. Adam’s canons namely Equity, Certainty, Convenience and Economy are a set of criteria by which to judge taxes and determine a good tax.

Although these canons were presented in 1776, they are still used as the foundation of discussion on the principles of taxation[7]. His four original principles are commonly referred to as the “Original or Main Canons of Taxation“.

- Equity of contributions: ‘The subjects of every state ought to contribute towards the support of the government, as nearly as possible, in proportion to their respective abilities; that is, in proportion to the revenue which they respectively enjoy under the protection of the state.’

- Certainty of tax liabilities: ‘The tax which each individual is bound to pay ought to be certain, and not arbitrary. The time of payment, the manner of payment, the quantity to be paid, ought all to be clear and plain to the contributor, and to every other person. Where it is otherwise, every person subject to the tax is put more or less in the power of the tax gatherer, who can either aggravate the tax . . . or extort . . . some present or perquisite to himself.’

- Convenience of payment: ‘Every tax ought to be levied at the time, or in the manner, in which it is most likely to be convenient for the contributor to pay it.’

- Minimisation of costs: ‘Every tax ought to . . . take out and to keep out of the pockets of the people as little as possible over and above what it brings into the public treasury of the state, . . . in the four following ways. First, the levying of it may require a great number of officers, whose salaries may eat up the greater part of the produce of the tax . . . Secondly, it may obstruct the industry of the people, and . . . may thus diminish, or perhaps destroy, some of the funds which might enable them more easily to pay. Thirdly, by the forfeitures and other penalties which those unfortunate individuals incur who attempt unsuccessfully to evade the tax, it may frequently ruin them, and thereby put an end to the benefit which the community might have received from the employment of their capitals . . . Fourthly, by subjecting the people to the frequent visits and the odious examination of the tax gatherers, it may expose them to much unnecessary trouble, vexation, and oppression . . . It is in some one or other of these four different ways that taxes are frequently so much more burdensome to the people than they are beneficial to the sovereign.’

In this third part we provide a brief history of taxation, starting with early forms of taxes in Mesopotamia and ancient Egypt, which were paid in crops, goods, and labour. The origin of the word “tax” is traced back to the 14th century, and there are biblical references to taxes. This section highlights the implementation of income taxes in Great Britain and the United States during times of war. We also discuss the classification of taxes into direct (based on the ability to pay) and indirect (levied on production or consumption) taxes. The principles of taxation, known as the “canons of taxation,” are attributed to Adam Smith and include equity of contributions, certainty of tax liabilities, convenience of payment, and minimization of costs. These principles continue to be relevant in discussions on the principles of taxation.

Now that we have an idea about money and taxation, what are the effects of cashless society on taxation?

[1] (Smith, 2015) see references

[2] https://en.wikipedia.org/wiki/Zakat

[3] https://en.wikipedia.org/wiki/Tax#History

[4] https://en.wikipedia.org/wiki/Industrial_Revolution

[5] https://en.wikipedia.org/wiki/Jizya

[6] https://www.britannica.com/topic/taxation/Classes-of-taxes

[7] https://www.ciat.org/principios-de-la-tributacion-equidad-e-igualdad/?lang=en

Nyatefe Wolali DOTSEVI: Tax Research Manager, WATAF Secretariat

Views Today : 23

Views Today : 23 Total views : 7622

Total views : 7622