Tax compliance is influenced by numerous factors. Taxpayer perceptions of the tax system, trust in the state, social solidarity, and economic conditions, among others, often presuppose the willingness of taxpayers to comply with the tax law of their jurisdiction. While the lack of equity, accountability, and transparency has a tremendous propensity to preclude tax administration from mobilizing more domestic revenue, research has also demonstrated that in some countries, such as Senegal or Sierra Leone, taxpayers are eager to comply with their tax obligations provided that they are not ostracized from public services (Adegboye, 2023).

Sierra Leone’s economy is primarily driven by mining, agriculture, and fishing. The country is rich in mineral resources, including diamonds, gold, bauxite, and iron ore. However, the country faces several challenges, including economic, educational, transportation, and health services. For instance, the past outbreak of the Ebola virus in 2014 revealed an inequity in the

distribution of both health centers and health workers between the capital city, Freetown, and the provinces.

This disparity was also noticeable during the COVID-19 pandemic. Van den Boogaard, Prichard, & Orgeira, (2023) posited that over the course of their data collection period, 35 percent of households and 31 percent of businesses reported receiving some type of relief with this distribution:

- Types of relief items: In the provinces, 95% of respondents reported receiving Veronica buckets, 65% reported receiving soaps, and 62% reported receiving masks. In Freetown, these percentages were 72%, 18%, and 12%, respectively.

- Food aid and cash transfers: 13% of respondents in the provinces reported receiving food aid compared to 20% in Freetown, while 1% in the provinces reported receiving cash transfers compared to 6% in Freetown.

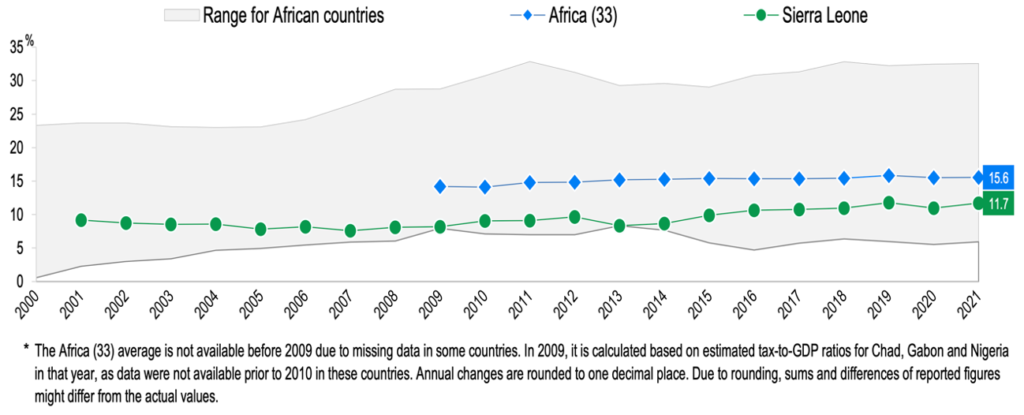

Even though, there is improvement in revenue mobilization (the tax-to-GDP ratio in Sierra Leone increased by 0.7 percentage points from 11.0% in 2020 to 11.7% in 2021, as shown in Figure 1 below), with positive changes in taxpayer perceptions of the tax system from 2011 to 2021, further analysis by Van den Boogaard, Prichard, & Orgeira, (2023) elicited a contrast in tax compliance and perception of tax fairness between Freetown and provinces.

Figure 1: Sierra Leone Tax-to-GDP ratio over time

Source: Revenue Statistics in Africa (OECD, ATAF, & AUC, 2023) – Sierra Leone

According to Van den Boogaard, Prichard, & Orgeira, (2023) in Freetown, there was a decline in willingness to pay additional taxes over the course of the COVID-19 pandemic. This decline was particularly notable in the capital city, where support for paying additional taxes eroded over time. Meanwhile, in the provinces, there were initially high levels of support for paying additional taxes, but this support also declined over time.

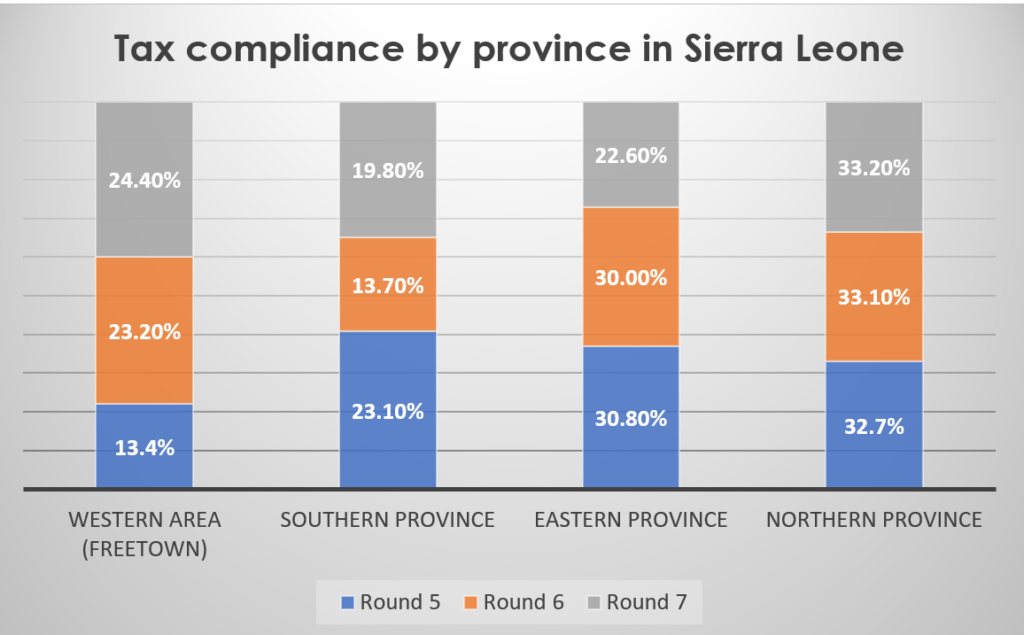

Addressing the perception of tax fairness, Van den Boogaard, Prichard, & Orgeira, (2023)found that in Freetown, there was a decline in the belief that taxpayers should only pay taxes if the government represents their interests, which suggests a decrease in the perception of tax fairness. This attitude, which was confirmed, when Adegboye, (2023) was examining Afrobarometer surveys (2014, 2016, and 2019), contrasts with the provinces inasmuch as they have access to public service delivery. Figure 2 below shows the tax compliance rate of the four[1] constituencies.

Figure 2: Tax compliance by province in Sierra Leone

Source: Culled from (Adegboye, 2023) figures.

In conclusion, these findings underscore the need for improvements in tax administration and policy frameworks to mobilize revenue in Sierra Leone. The provincial variations in tax compliance attitudes and the economic and social challenges faced by the country highlight the importance of addressing these issues to promote tax compliance and inclusive development.

References

Adegboye, A. (2023, May). Tax Compliance Attitude in West Africa: Evidence from Senegal and Sierra Leone. WATAF-DP/23/001. https://wataf-tax.org/2023/05/31/tax-compliance-attitude-in-west-africa-evidence-from-senegal-and-sierra-leone/

OECD, ATAF, & AUC. (2023). Revenue Statistics in Africa 2023 ─ Sierra Leone. Retrieved from https://oe.cd/revstatsafrica

Van den Boogaard, V., Prichard, W., & Orgeira, N. (2023, May). The Politics of Taxation and Tax Reform in Times of Crisis: Covid-19 and Attitudes Towards Taxation in Sierra Leone. ICTD Working Paper 166.

[1] Sierra Leone was divided into three provinces before 2017. The provinces were:

- Eastern Province

- Northern Province

- Southern Province

Sierra Leone is now divided into four provinces (until 2017, three) and one Western Area (Freetown); these are further divided into 16 districts (previously 14), and the districts are further divided into 190 (previously 149) chiefdoms. The provinces are:

- Eastern Province

- Northern Province

- Southern Province

- North West Province

https://en.wikipedia.org/wiki/Provinces_of_Sierra_Leone (Consulted in October 2023)

Nyatefe Wolali DOTSEVI: Tax Research Manager, WATAF Secretariat.

Views Today : 19

Views Today : 19 Total views : 63351

Total views : 63351