“People worry about it, think of ways to get more of it, and dream about how to spend it. But how much do we really know about money?”

(Amy Tikkanem)

Our intention is not to dive into numismatic science, but to give an overview of the history of money.

There has been a long history about the journey of money, which evolved from nature. History had it that some European countries accepted cowrie shells as currency which was first used as money about 1200 BCE.

Another notable currency from nature was whale teeth, which were used by Fijians. And the people of Yap Island (now part of Micronesia) carved huge disks of limestone that eventually became currency and remain part of the island’s culture[1].

France, Russia and early ancient Rome had used leather and animal hide as some form of currency. This was about the 6th century BCE.

Amy reported that the Chinese emperor Wudi who reigned from 141–87 BCE created currency out of skins from his personal collection of white stags which he decorated with elaborate designs. Indeed, some believe it gave rise to the use of buck as slang for dollar.[2]

People originally traded surplus commodities with each other in a process known as bartering. However, there were many inconveniences in this system. Here are three of them:

- the improbability, of coincidence between persons wanting and persons possessing;

- the complexity of exchanges, which are not made in terms of one single substance; and

- the need of some means of dividing and distributing valuable articles.

Money as commodities

Money evolved as a practical solution to the complexities of bartering hundreds of different things. Over the centuries, money has appeared in many forms.

Table 1: Different forms of money

Money as coins

According to many historians, it was during the 7th century BCE that the kingdom of Lydia (which is present-day Turkey) issued the first regulated coins. It is also reported by DK publishing (2017) that in Asia Minor, from around 600 BCE, the first coins were minted in Lydia. While Jevons (1875), according to the finding of small stamped ingots of silver, which have been found in Ægina argued that coins might be invented about 900 B.C.

Coins were a mixture of gold and silver formed into disks stamped with inscriptions. For more than 2,000 years, coins made from precious metals such as gold, silver, and copper formed the main medium of monetary exchange. Account by Prof. Kusimba (2017)[5] had it that the discovery of hordes of coins of lead, copper, silver and gold all over the globe suggests that coinage – especially in Europe, Asia and North Africa – was recognized as a medium of commodity money at the beginning of the first millennium A.D noting that the wide circulation of Roman, Islamic, Indian and Chinese coins points to premodern commerce (1250 B.C. – A.D. 1450).

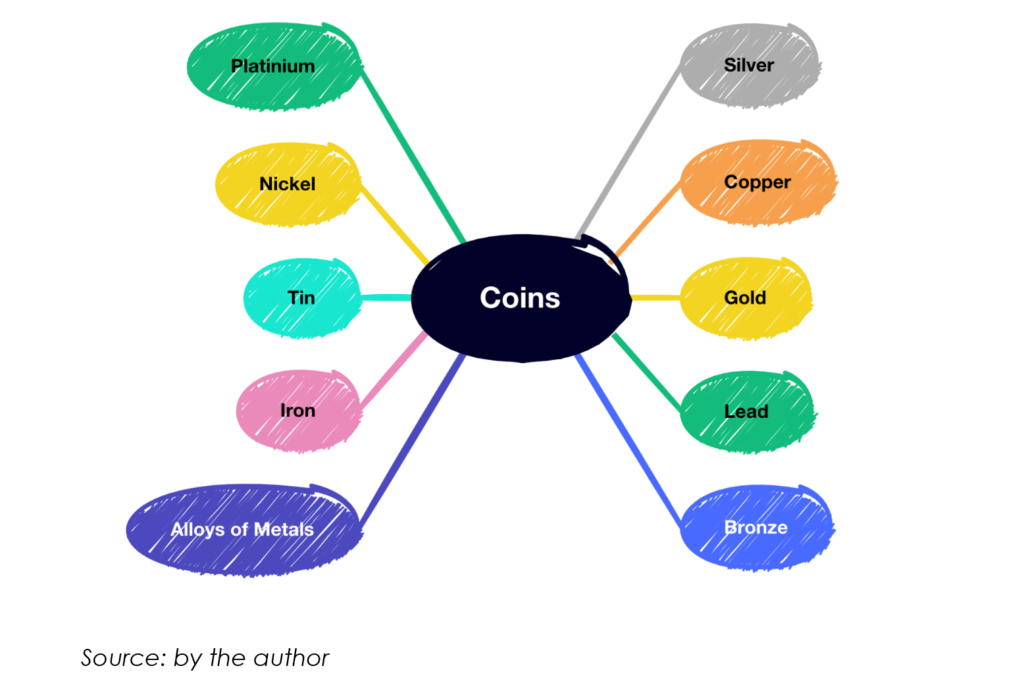

Coinage as commodity money owes its success largely to its portability, durability, transportability and inherent value. It is worth to note that different types of metals were also used to mint coins over ages. The next figure shows some of them.

Figure 2: Different metals used to mint coins

Source: Draw by author

Money as bank notes

« With barter they begin and with barter they end; but the second form of barter, as we shall see, is very different from the first. »

William Stanley Jevons (1835-1882), Money and the Mechanism of Exchange (1875).

Peoples who used gold and silver money generally found over time that tokens of little metal value, or even pieces of leather and paper of face value, could change hands as tokens of coin ownership. What replaces gold, silver or copper money is initially purely representative. The process started in premodern China, and corroborated by Amy, the need for credit and the circulation of funds that were less onerous than exchanging thousands of copper coins led to the introduction of paper money.

Amy was of the view that bank notes was made from the bark of mulberry trees (so, in a sense, money really did grow on trees), and by the late 18th and early 19th centuries, paper money had spread to other parts of the world, though not money in the traditional sense, rather it served as promissory notes —”promises to pay specified amounts of gold or silver— which were key in the development of banks”.

This economic phenomenon was a slow and steady process that win the race from the late Tang Dynasty (618–907 CE) to the Song Dynasty (960–1279 CE). It began as a means for merchants to exchange heavy coinage for receipts of deposit issued as promissory notes from shops of wholesalers, notes that were valid for temporary use in a small regional area[6]. Thus arises the peculiar phenomenon known as an inconvertible paper money. Such a currency is, conversely, never accepted outside the borders of the state recognizing it.

Traders conducting large international transactions soon found that when trading cash, there was a large loss of interest and the risk of losing all of your money. Those who often traded, bought and sold with each other found it absurd to pay a certain amount of money for what they bought and then get it back for what they sold. It was enough to estimate the value of the exchanged items in money and pay the difference, if any, in cash.

The practice having grown up of depositing the money not immediately wanted with goldsmiths (the metallic one) or bankers, for safe custody, it was gradually discovered that an order to pay money would serve instead of the money itself; and that, if two persons trade with the same banker, they need not in their mutual transactions handle the money at all. That is undoubtedly the starting point of a cashless economy. We will find later that bankers did not circumscribe themselves as only intermediaries.

Money as Credit Cards

Amy posited that although credit has existed for ages, the first universal credit card was not introduced until 1950. That year Americans Ralph Schneider and Frank McNamara founded the Diners Club. Other cards were soon created, and in 1959 American Express debuted a plastic card.

In 1960, IBM introduced magnetic stripe on credit cards, to contain account information. Because of the stripe, merchants no longer needed to make phone calls to obtain authorization from credit companies.

In the 1990s, cards began to have chips embedded in them to encrypt their information, providing even greater security. Previously, credit card users were required to pay the full balance at the end of the month.

Eventually, American Express allowed consumers to carry balances—though interest was applied—and other credit companies quickly followed. Customers took advantage of this development and by 2017 it became possible for American consumers to carry $1 trillion in credit card debt.

Money as bits [11000000]

The second half of the twentieth century brought new ways to think systematically about bulk payment methods. Successive generations of researchers and managers in financial institutions have discussed and theorised their uses and visualised their societies in a future in which material representations of money play no part. This agenda is related to the emergence of the term “Cashless / Checkless Society” which appears to have originated in the business world. It was coined in the United States in the mid-1950s to describe the future state of the economy in which the electronic transaction system replaced the use of coins, cheques, and banknotes as a medium of exchange (Batiz-Lazo & al., 2014).

The rapid advances in computing and development of information technology during that period and at the beginning of the 21st century has led to an acceleration of the process of digitisation of money. From cryptocurrencies such as Bitcoins to Central Bank Digital Currency issued by some apex banks for their citizens for their transactions[7], the Money 2.0 intimately linked to the blockchain technology continues its little way around the world.

Bitcoins

Bitcoin is a digital currency system created in 2009 by an anonymous computer programmer or group of programmers known as Satoshi Nakamoto who used SHA-256, a cryptographic hash function, in its proof-of-work scheme[8]. The currency which previously belonged to geeks world but now available to general public is not issued by a central bank and is not regulated, though a decentralized network of computers keeps track of transactions. Users of Bitcoins are anonymous, known only by their digital wallet ID. The value of Bitcoins is determined by bidding, similar to the way stocks are valued. How are Bitcoins created?

In a process called mining. This involves a race between computers to solve complex math problems and thus verify blocks of transactions. While that may sound easy, it isn’t. It’s estimated that nearly seven trillion attempts may have to be made before a solution is discovered. In the end, the owner of the winning computer gets newly created Bitcoins, and the system is made more secure. The cap for the number of Bitcoins that can be created is 21 million, and more than 17 million have been created so far.

In this second part, a historical overview of money evolution was provided. How money originated from natural items like cowrie shells and whale teeth, and how different civilizations used various materials such as leather, animal hides, and carved limestone as forms of currency was presented. Eventually, paper money emerged, starting with promissory notes and evolving into inconvertible paper money. The concept of credit cards came into play in the 20th century, followed by advancements such as magnetic stripes and embedded chips for enhanced security. The digital age brought about the concept of cryptocurrencies, with Bitcoin being the most well-known example.

In the following part, we will focus on properties of money and taxation.

[1] A Brief (and Fascinating) History of Money | Britannica

[2] A Brief (and Fascinating) History of Money | Britannica

[3] (Jevons, 1875) see references

[4] https://en.wikipedia.org/wiki/Money

[5] When – and why – did people first start using money? (theconversation.com) accessed on 16th May, 2023

[6] https://en.wikipedia.org/wiki/Money

[7] https://guardian.ng/news/nigeria-launches-enaira-digital-currency/

[8] https://en.wikipedia.org/wiki/Cryptocurrency

Nyatefe Wolali DOTSEVI: Tax Research Manager, WATAF Secretariat

Views Today : 5

Views Today : 5 Total views : 7604

Total views : 7604