“In the theory of money, it is curious and worth noting that its usage was first considered progress and that, once it existed, getting rid of it was considered further progress.”

Léon Walras (1834 – 1910) Théorie de la circulation et de la monnaie (1874)[1]

General introduction

For ages, money has meant little metal disks and rectangular slips of paper. Yet the usefulness of physical money – to say nothing of its value – is coming under fire as never before. The cashless policy adopted by the Central Bank of Nigeria (CBN)[2] to curb criminality and restore the monetary system devoid of bank notes that have been ousted continue to make headlines.

What is the implication of this policy on taxation? What are the ways to mitigate the risk on revenue mobilisation? How taxation was administered in a cashless society before?

In this five-part publication, we will explore the concept of money and its evolution towards a cashless society. Discover the implications of the cashless policy adopted by the Central Bank of Nigeria and how it affects taxation. Learn about the ways to mitigate risks on revenue mobilisation and how taxation was administered in a cashless society before.

In Part 1, we will examine cashless society and emphasize on what is money and its functions. Part 2 will discuss the journey of money from ancient time. including its functions, forms, and characteristics. Then Part 3 will explore the properties of money and underline what is taxation and its features in modern world. Furthermore, Part 4 will focus on history of taxation, including its main principles designed to mitigate risks on revenue mobilisation. Finally, Part 5 will explore the implications of a cashless economy on taxation, including the outcomes related to revenue mobilisation.

What is Cashless Society?

A cashless society has been defined as one which cash in the form of physical bank notes and coins is not accepted in any financial transaction, rather, money is transferred to one another in a digital model, at times via credit or debit cards, online electronic money transfers, as well as cryptocurrency and other models transferred electronically.

According to Brian Duigna, a cashless society as one in which cash, in the form of physical banknotes and coins, is not accepted in any financial transaction. Instead, people and businesses transfer money to one another digitally by means of credit or debit cards, electronic money transfers, cryptocurrency, or online and mobile payment services, such as PayPal and Apple Pay.

He posited that there are various measures of cashlessness, yielding different rankings of countries along a “cashless continuum,” but he quickly noted that most experts agree that Sweden is now closest to the cashless ideal. In Sweden, cash is now used in less than 15 percent of transactions in that country, and the value of cash in circulation has declined significantly in the 21st century, now representing about 1 percent of GDP[3].

He also observed that Swedish retailers and restaurants are now permitted to refuse cash payments merely by posting a sign, and more than half of all Swedish bank branches no longer handle cash. He concluded that in order to facilitate the transition to cashlessness, central banks in some countries have introduced government-backed digital currencies to replace or complement banknotes and coins, as it is the case in Nigeria.

What is money?

First, people bartered, making direct deals between two parties of desirable objects. Money came a bit later. Its form has evolved over the millennia – from natural objects to coins to paper to digital versions. But whatever the format, human beings have long used currency as a means of exchange, a method of payment, a standard of value, a store of wealth and a unit of account[4]. (Kusimba, 2017)

This question, what is money? at first looks very easy. One can answer that money is a legal tender used in a country for transactions. However, when look at it closer we will find out it is more complex than that. Money, a medium of exchange, has been known as a system of value that facilitates the exchange of goods in an economy. Money, generally facilitates transactions of goods and services. Money is what money does. (Walker)

The word money derives from the Latin word moneta with the meaning “coin” via French “monnaie”[5]. Money is a commodity whose economic function is to facilitate the interchange of goods and services (Ludwig von Mises, 1912). You may have notice that money is defined by its function related to a scope. Ludwig also claimed that “for the jurist, money is a medium of payment” since the principal, although not exclusive, motive of the law for concerning itself with money is the problem of payment.

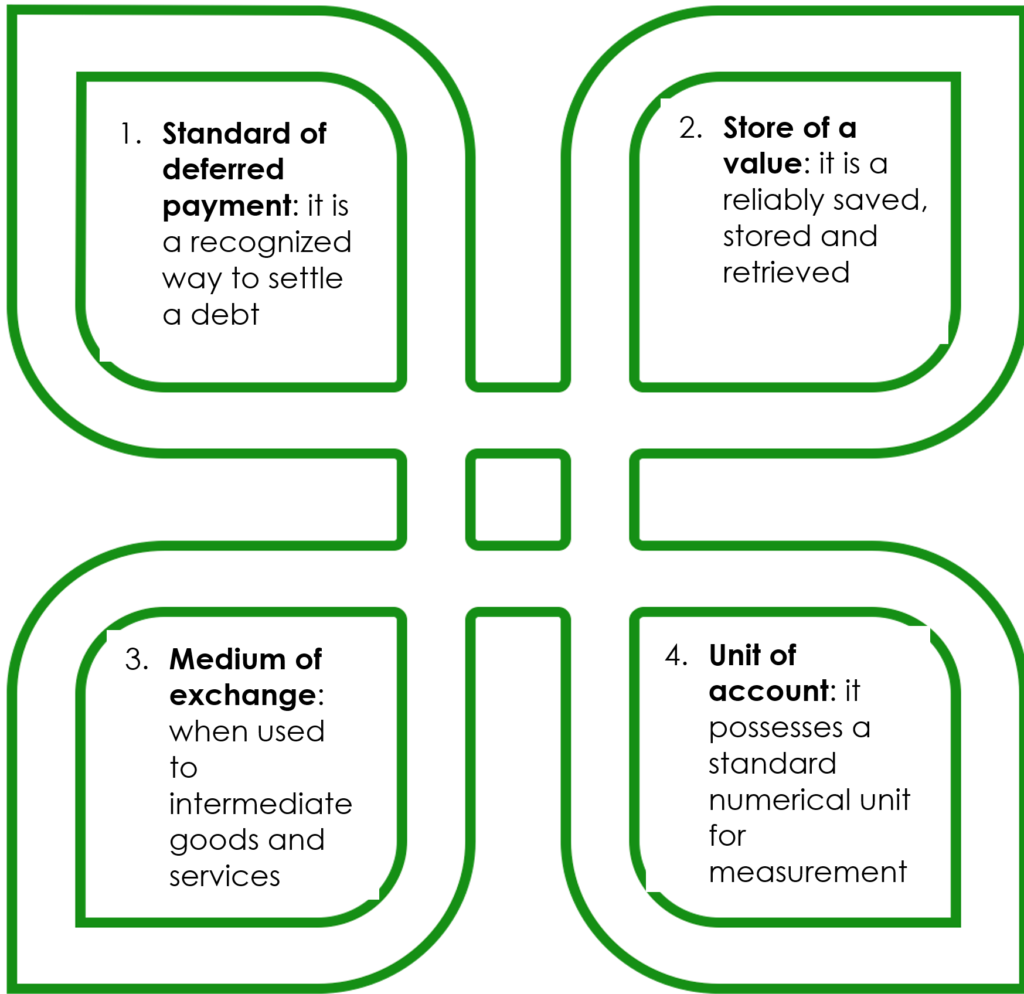

According to Jevons (1875) in his book “Money and the Mechanism of Exchange”, money is the measure and standard of value and the medium of exchange. He famously analysed money in terms of four functions: a medium of exchange, a common measure of value (or unit of account), a standard of value (or standard of deferred payment), and a store of value[6] that we epitomize in the figure below.

Figure 1: Four functions of money

Source: Design by author

In this first part we examine the concept of money and its functions. Money is defined as a legal tender used in a country for transactions, a medium of exchange, a system of value that facilitates the exchange of goods in an economy, and a commodity whose economic function is to facilitate the interchange of goods and services.

Next, we will look at how the concept of money has evolved throughout ages from ancient times.

[1] (Walras, 1874) see references

[2] CBN : Central Bank of Nigeria

[3] What Is a Cashless Society and How Does It Work? | Britannica

[4] When – and why – did people first start using money? (theconversation.com) accessed on 10th May, 2023

[5] https://en.wikipedia.org/wiki/Money

[6] https://en.wikipedia.org/wiki/Money

Nyatefe Wolali DOTSEVI: Tax Research Manager, WATAF Secretariat

Views Today : 101

Views Today : 101 Total views : 63433

Total views : 63433