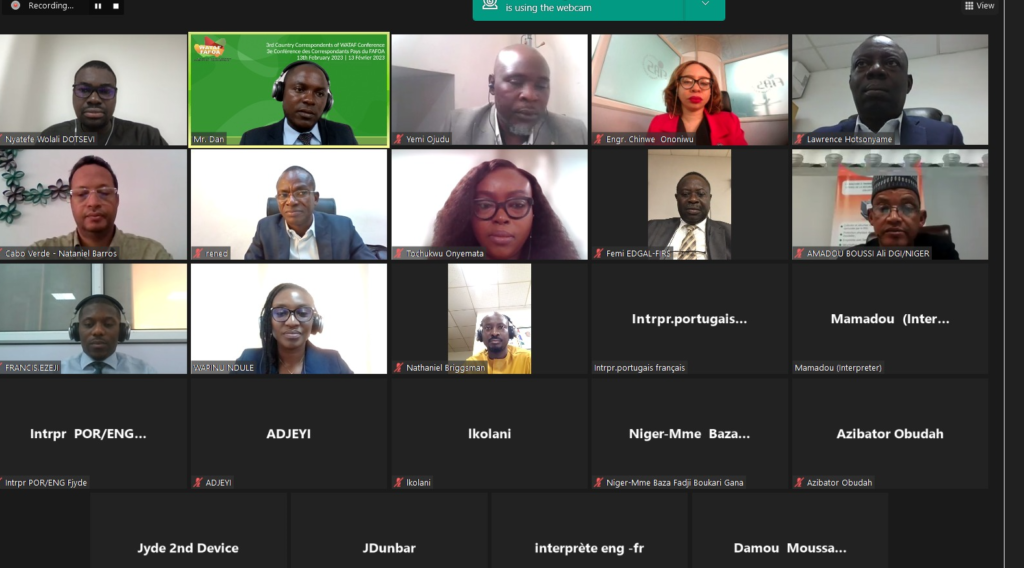

The West African Tax Administration Forum (WATAF) organised a virtual Country Correspondents’ Conference, on 13 February, 2023. The theme of the conference was “The Digitalisation of the Tax Systems and the Future of Tax Administrations in West Africa”.

Participants were introduced to the concept of digitalisation of tax systems and its benefits to members’ tax administration. In addition, it was an occasion to showcase steps that WATAF is taking to assist member states in their digitalisation journey in the next decade. These include: (i) capacity development programmes; (ii) needs-based technical assistance; and (iii) tools for assessing the level of digitalisation of tax systems, such as the OECD’s Digital Transformation Maturity Model (DTMM) and the WATAF’s Tax Administration Capability and Intelligence Maturity Systems (TACIMS).

The TACIMS is a tool developed by the WATAF Secretariat for evaluating the tax administration system’s maturity in terms of using data to generate intelligence about taxpayer compliance behaviour, using technology as a key enabler, and making it simple for the taxpayer to communicate with the tax authority about general compliance and other activities.

Even though there are other tools like TACIMS, it is made to deal with the problems that only tax administrations in West Africa face. Speaking about the TACIMS one of the participants stated:

“I see a resemblance between TACIMS and TADAT, which is being rolled out in many African countries. I think we need to develop our own assessment tools since we have a lot in common. TACIMS will surely be a good assessment tool for West African countries.”.

The conference was also an opportunity to update member states’ country correspondents on the Forum’s 2023 activities as well as outline their roles and expectations towards the realisation of the 2023 WATAF annual plan.

As always the case, the conference ended with friendly discussions among country correspondents, peer learning, and networking.

Views Today :

Views Today :  Total views : 63448

Total views : 63448