In its attempt to fulfil its function of correcting externalities, besides the primarily one of raising revenue aimed at financing public expenditures, and the redistribution of income and wealth both intra and inter generations, taxation seems to be the panacea to curb the rampant and worrisome addiction of millions of people to mayhem products such as tobacco, alcohol, and other nicotine products, etc. The addiction to tobacco is one of the main concerns of public health institutions in various countries as well as the World Health Organization (WHO) at the global level. Before delving into how the partnership between public health and public finance policymakers tends to tackle this challenge with the support of tax organizations viz., WATAF[1], ATAF[2], CIAT[3], CATA[4] etc., akin regional organizations like ECOWAS, let us reflect on how tobacco inundated the sub-region of West Africa.

According to Professor Nicoué Gayibor in the twain volumes of “The Ewe (Togo, Ghana, Benin) – History and Civilization”[5], tobacco was the flagship product trafficked by European slave traders among: (i) the malfunctioning mediocre quality fire guns meant deliberately to explode in the hands of the user; (ii) the poor and lamentable dinanderie and metal articles that annihilate the metallurgic and ceramic craft industry in the region; (iii) the junk articles and knickknacks; (iv) the textiles that slowly and steadily destroy the looms of weavers; and utmost (v) the noxious and vitriolic beverages that imported dipsomania in the Gulf of Guinea between the sixteen and nineteen centuries. His assertion is corroborated by Drs. Judith Mackay and Michael Eriksen in “The tobacco atlas”[6], where the scholars posit that tobacco was shipped to Africa around 1560 by the Portuguese and Spanish. In addition, in numismatic history, both authors argue that European settlers grew tobacco and used it as a form of currency in the 1650s in South Africa.

Moreover, Professor Nicoué Gayibor asserts that the Mephistophelian Portuguese transatlantic traffickers were shipping the lowest quality and vitiate tobaccos that were strictly forbidden to be sold in Portugal. Such nefarious scraps of tobacco obtained after the extraction of the first and second quality of tobacco leaves (for European markets) cropped in Brazil, were copiously mixed with molasses when they were rolled for Africa. The academic emphasizes that even though meretricious tobacco was expensive, its consumption spread rapidly like a malignancy across the Gulf of Guinea, as did the imported tobacco pipe that crushed the production of local tobacco pipe[7] for smoking. It is crystal clear that smokers of such sham were ruining themselves to afford multiple cancers, particularly lung cancer, and enhancing their risks of heart diseases, strokes, emphysema, and many other fatal and non-fatal illnesses. What is the current situation?

According to the tobacco atlas[8], “the tobacco epidemic continues…”. The WHO computed in 2002, that tobacco kills more than AIDS, legal drugs, illegal drugs, road accidents, murder, and suicide combined, and projected in the same year that between 2025 and 2030, 3 million people will die from tobacco in developed countries along with (the worse) 7 million in developing countries[9]. That is one of the conspicuous reasons why, in collaboration with tax organizations and others, the WHO is advocating for the raising of tobacco prices by using the tax system as the most effective preventive measure to restrain the dramatic trend.

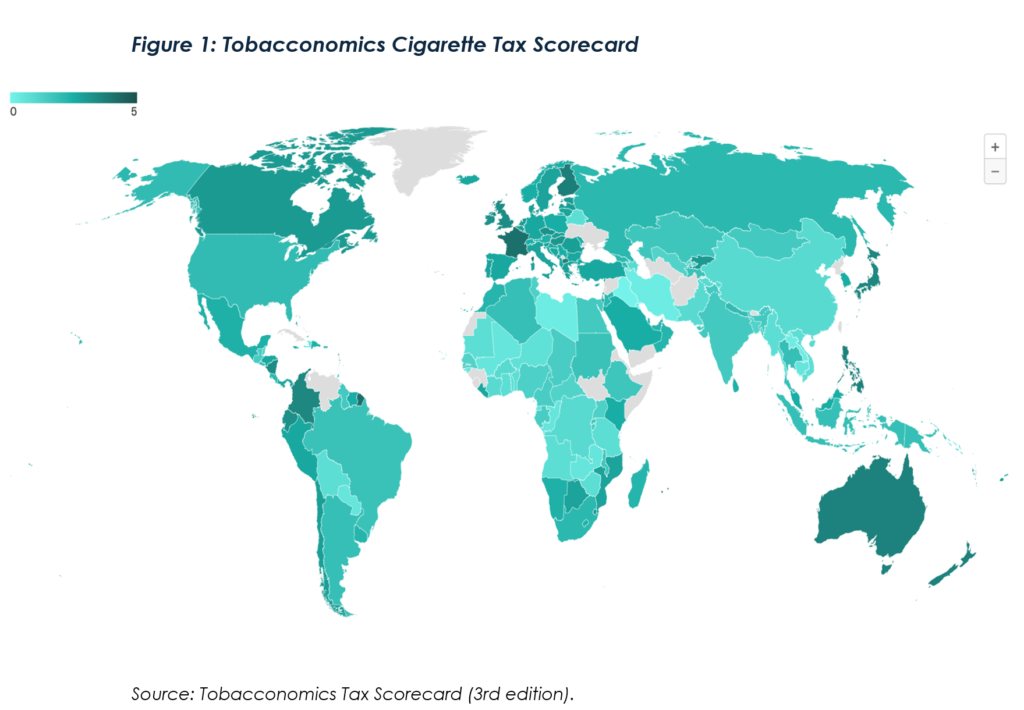

Unfortunately, the Scorecard, which evaluates the strength of tobacco tax systems on a scale of 0 to 5 points on four measures using the latest WHO data from 2022 and other key data sources: price, change in affordability, tax share of price, and tax structure[10], figured out that the global average score in 2022 declined to only 1.99 points out of 5, marking a reversal on the slight progress seen from 1.89 points in 2014 to 2.25 points in 2020. Subsequent to the release of the second edition of the Scorecard, which is based on data from 2020, it was observed that tobacco tax policies became less effective in 76 countries and only improved in 31 countries[11] (see figure 1 below).

This regression in the overall average score is a sign that more actions need to be taken to empower jurisdictions to conceive and implement robust tobacco tax strategies through workshops, seminars, and technical assistance.

According to the Tobacco Taxation Factsheet (2019), more than 8 million deaths globally are caused by tobacco each year, with more than 80% of the world’s smokers living in low- and middle-income countries. The cost of tobacco in West Africa, both in terms of its negative impact on public health and the economy, will continue to grow if governments do not take decisive action to limit its use. Increasing tobacco excise taxation is the most effective way to reduce tobacco consumption and improve health outcomes, while also raising government revenues[12].

Fortunately, WATAF, in partnership with various stakeholders, is enthusiastically ready to back initiatives that will enhance efforts to combat preventable deaths. These actions are simultaneously aligned with Sustainable Development Goal 3[13], which is to ensure healthy lives and promote well-being for all at all ages, and Agenda 2063 Goal 3[14], advocating for improved health outcomes for Africans.

[1] WATAF : West African Tax Administration Forum

[2] ATAF : African Tax Administration Forum

[3] CIAT: Centro Interamericano de Administraciones Tributarias

[4] CATA : Commonwealth Association of Tax Administrators

[5] Gayibor, N. (2021). The Ewe (Togo, Ghana, Benin) – History and Civilization. Lomé: Presse de l’Université de Lomé.

[6] Mackay, J., & Eriksen, M. (2002). The tobacco Atlas. London: World Health Organization.

[7] (Gayibor, 2021), see above

[8] https://tobaccoatlas.org

[9] (Mackay & Eriksen, 2002), see above

[10] https://tobaccoatlas.org/inadequate-tobacco-tax-policies-threaten-global-tobacco-control-progress/

[11] ibid

[12] https://www.ictd.ac/wp-content/uploads/2020/05/Nigeria_Tobacco_Tax_Factsheet.pdf

[13] https://sdgs.un.org/goals/goal3

[14] https://au.int/en/agenda2063/sdgs#:~:text=3.,Healthy%20and%20well%2Dnourished%20citizens.&text=Health%20and%20nutrition-,3.,for%20all%20at%20all%20ages.

Nyatefe Wolali DOTSEVI: Tax Research Manager, WATAF Secretariat.

Views Today : 19

Views Today : 19 Total views : 63351

Total views : 63351