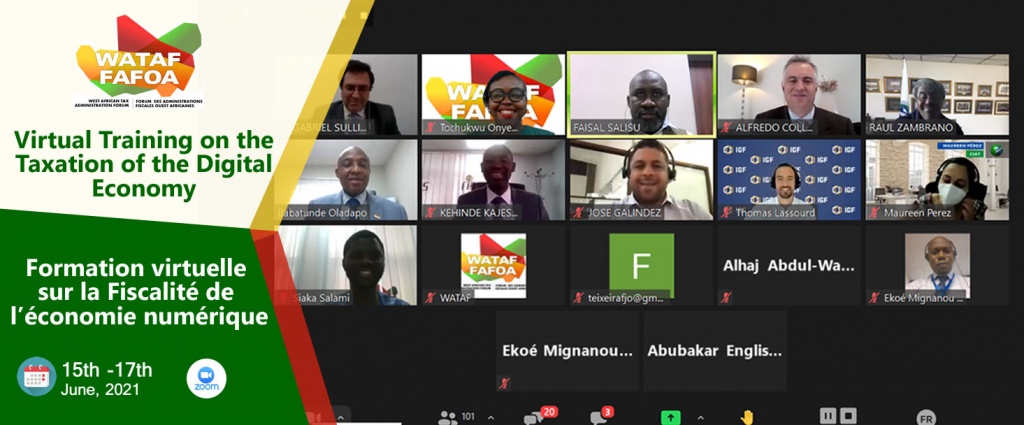

The West African Tax Administration Forum (WATAF) in collaboration with the Inter-American Center of Tax Administrations (CIAT) and Organisation for Economic Co-operation and Development (OECD) held a virtual training on “Taxation of the Digital Economy” from 15-17 June, 2021.

The training was an opportunity to share experience among members, in order to strengthen the Revenue Authorities in understanding the dynamics of the digital economy and formulating sound domestic policy frameworks, which will assist in preventing tax revenue leakages and improving revenue collection.

During the three (3) Days training, the Facilitators, who were drawn from tax administrations of Member States, CIAT and OECD discussed different models for the taxation of the Digital Economy, including solutions proposed by the OECD and UN. Also, specific countries’ initiatives on the subject were covered. These include Australia, France, Italy, India, Indonesia, Kenya and Nigeria.

The training attracted an average of 120 participants across 14 out of 15 Tax Authorities from Member States, including officials from CIAT.

We are optimistic that the knowledge gained has improved participants’ understanding of the dynamics of international taxation with regards to the taxation of the digital economy and confident that it will result in an improved revenue generation within West Africa.

Our special thanks goes to the Facilitators and all those that contributed to the success of the training.

Views Today : 13

Views Today : 13 Total views : 63345

Total views : 63345