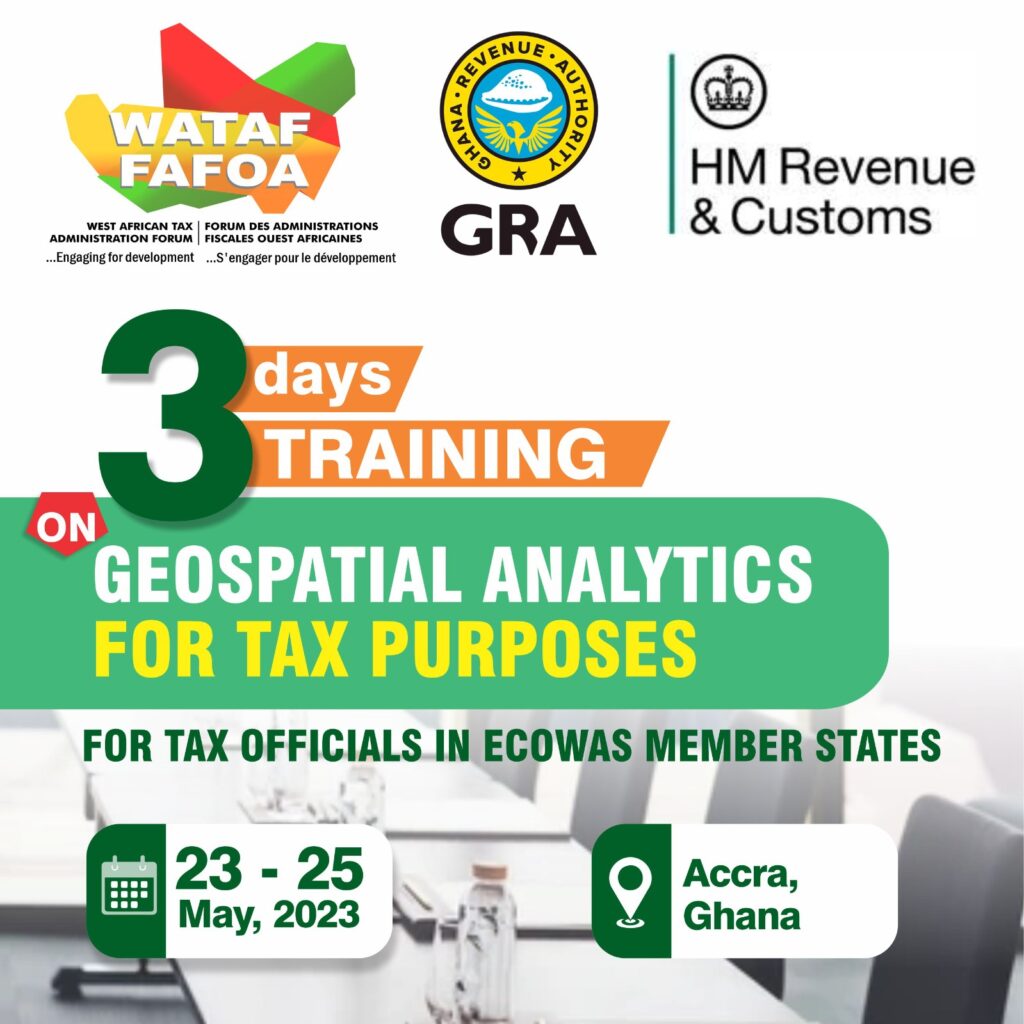

The West African Tax Administration Forum (WATAF), with the support of His Majesty’s Revenue and Customs (HMRC), organises a 3-day training course for tax officials in ECOWAS member states on “Geospatial Analytics for Tax Purposes”, from 23-25 May, 2023, in Accra, Ghana. Read the concept note for more information:

Views Today : 28

Views Today : 28 Total views : 7463

Total views : 7463